General average adjustment is a long process, to ask the clearing bank to professional calculation.

The ship owner will declare general average within a reasonable time of arrival at the first port after general average and notify the cargo and the ship's insurer. If you have a similar accident, please report to the insurance company as soon as possible, listen to their professional advice, and the insurance company will take over. All Header Connectors, Terminal Blocks and Bicycle Reflectors field are the same way to do.

The ship and the adjuster usually require the cargo to provide general average guarantee and sign the average agreement before delivery. With regard to the form of security, for goods insured, the ship and the adjuster usually accept the general average guarantee letter signed by the insurance company, while the goods not insured usually require the goods to provide the adjuster with a general average margin (if neither the buyer nor the seller wants to pay compensation or margin and the seller does not pick up the goods, the goods will be auctioned to cover general average). In addition, the ship usually requires the cargo to provide relevant documents to prove the value of the goods.

The cargo party shall immediately confirm the condition of the goods to the shipping company, retain evidence in this regard, inquire about the first destination of the ship, arrange the inspection in time, and be able to entrust the forwarder to assist the goods to the designated port of destination at the first time. They can reduce unnecessary losses.

In the absence of facts and evidence that general average can not be established, the insurance company or the inspection agent shall promptly provide the general average guarantee to the ship and attach the value of the goods at the same time, In order not to guarantee the delivery of untimely or improper and by the ship retained goods.

In general, in order to make the goods reach the consignee as soon as possible and reduce unnecessary delay, the cargo side provides general average guarantee quickly. After the adjustment is completed, the negative general average assessment shall be paid after the review and approval of the adjustment report.

Nothing to say, buy insurance!

In marine insurance, insurance against "all risks" is the most convenience. Its coverage is F.P.A., W.P.A. and insured goods in transit due to external reasons caused by all or part of the loss. External reasons only refer to theft, delivery of goods, fresh water rain, short, mix, tarnished, leakage, damage, string taste, damp and heat, hook damage, packaging rupture, rust damage.

It should be noted that strike and war risks are not included in all risks, so additional risks can be purchased if shipped to war-torn areas or countries that love strikes, such as India and South America.

The insurance premium =CIF price ×110% for export goods. The rate of all risks for international shipping is usually 8/10000 to 3/1000. For most shippers, it may be hundreds of dollars. Don't put a big risk in order to save this money.

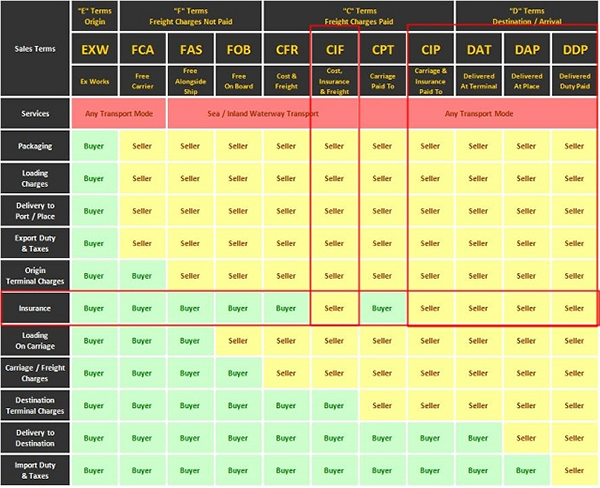

So who will pay for the insurance? It depends on which trade term you use.

There is a simple and easy form to collect:

Here is an explanation of the more commonly used CIF provisions:

CIF

Cost, Insurance and Freight, The seller handles freight insurance for the buyer and pays the insurance premium. If the buyer and seller do not agree on specific risks, the seller only needs to obtain the minimum insurance coverage. If the buyer requests additional war insurance, the seller shall insure the insurance at the buyer's expense.

CIF is one of the commonly used trade terms. If you do it CIF, but you don't buy insurance with a fluke, you can only admit it, you have to pay general average, and you may face claims from guests. Why? Should you buy insurance, you greedy small cheap did not buy, who do you say?

There is also a situation to pay attention to, some guests are very slippery, obviously talking to you FOB, but want you to make CIF, say let you find a forwarder to deliver to their port, but the guest only paid the freight, did not give you insurance. At this time if you think that anyway is talking about FOB price, insurance has nothing to do with you, you do not buy insurance, but the real thing is still yours. See, this is the guest in the transfer of risk! If the guest asks so, then you ask him for freight and insurance.

CIP

Carriage and Insurance Paid to

The seller delivers the goods to its designated carrier, during which the seller must pay the freight to the destination and insure the buyer against the risk of loss or damage to the goods in transit. That is, the buyer bears all risks and additional costs after delivery by the seller.

FOB

Under FOB (Free On Board) or CFR (Cost and Freight) terms, it shall be stipulated that the buyer shall insure (To be covered by the Buyers), and the seller shall inform the buyer of the freight information as soon as the shipment is arranged, and the buyer shall decide whether to purchase the insurance at his own discretion, so that avoid possible subsequent wrangling.

A foreign trade person shared with us his client's coquettish operation: the price is based on the FOB, but he will pay the seller the sea freight and the payment together and let the document show the CIF completely. Seller thought there was no loss on the promise, walked a few votes, now it seems to resolutely refuse. Indeed, this operation must be rejected, or the risk will belong to the seller.

And if he does FOB, but the end payment is not paid, even if the buyer buys insurance, he will probably be with the seller to bear the loss.

Post time: Dec-18-2020